Saakar Yadav – MyITreturn is one of the winners in the Aatmanirbhar Bharat App Innovation Competition in the Others category, assisting with the process of submitting income tax returns.

The Aatmanirbhar Bharat App Innovation Challenge, a competition sponsored by the National Informatics Center to encourage innovation in government-related apps, named myITreturn, a grassroots app that helps individuals file their income tax returns, one of the 24 winners in the Others category.

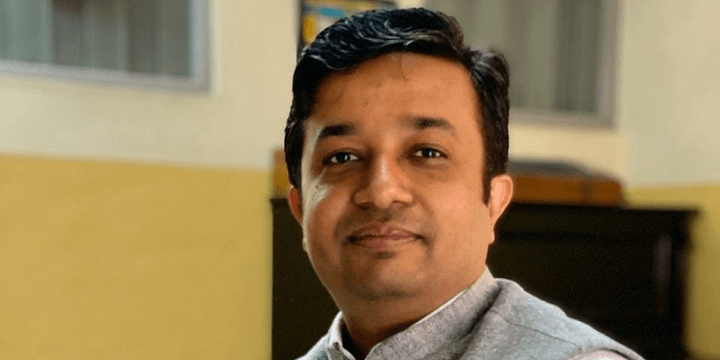

Saakar Yadav (myITreturn Founder)

MyITreturn (formerly known as myITrecover) was founded about six years ago and has grown a devoted user base by improving its website version, which was established in 2008. “Our motto is rather basic: assist every Indian file their I-T returns,” says Saakar Yadav, the founder of myITreturn.

It’s possible that you’ll be confused about the requirements for filing an income tax (I-T) return, which might make things more difficult. myITreturn was created to reduce user frustration and foster a feeling of confidence among users.

MyITreturn is bootstrapped and based in India, which means I’m confident about it,” says Saakar. “Nobody can demand that we sell our data to any third party, and we are not governed by shareholder expectations. Our goal is to provide excellent service to our customers,” he adds.

At the moment, the app has over 5 million downloads and an 80 percent retention rate. It is also available in nine Indian languages, allowing it to reach a larger audience.

“We take pleasure that our app is used by teachers, drivers, and even jawans,” adds Saakar.

nnThrough word of mouth and referrals, it has mostly grown its customer base at ItMyITreturn. It also contacted several businesses in an effort to assist their workers with filing their IT returns.

Core USP

MyITreturn’s main USP is the trust it has established among its users; the data generated is completely secure and cannot leave the country. Second, because it created its own software platform, the whole procedure is very simple: one may get an acknowledgment after submitting their return in just five minutes.

“Our technological platform, which combines AI and ML with advanced analytics to verify prior records, ensures the I-T return is accurate,” according to Saakar.

According to its website, eConnect support is available for about two years after which it is no longer offered.

Since the inception of myITreturn in 2007, I’ve helped individuals file their returns on numerous occasions. Because of this, myITreturn has developed a solid model without any advertising gimmick by providing these services for free. The app costs anything from Rs 200 to Rs 400 to file a return.

“We don’t have a free business model and we’re in this for the love,” Saakar adds.

Services offered

End-to-end services are available through the app, including pre and post-filing services for taxpayers. Pre-filing activities include tax planning, return preparation, and monitoring of returns, while post-filing operations include refund tracking and resolution of I-T notices.

The program also comes with tools for calculating taxes and producing rent receipts. It recently launched a monthly subscription service to assist customers in obtaining their credit score, TDS data, notice tracking, and identity monitoring on a regular basis.

Almost one million downloads have been registered for the iSaveITreturn app, which is now approaching one million copies sold. With an annual growth of 20 to 25 percent since its inception, the mobile application has more than 1.5 million users while the web platform claims to have over 1.5 million members.

Future plans

The road to myITreturn’s transformation into a “fin-tax” app platform has already begun, and it intends to change itself. This will enable clients to learn about a variety of additional financial services products, such as loans, insurance, and credit cards.

“We can now tell users which will be the best choice for them with our unique algorithm, which combines cutting-edge AI and ML. Users will be able to save money and receive the greatest possible savings by utilizing this tool,” says Saakar.

“We want to be a part of the growth of the expanding tax base,” says Saakar. “In India, only about four percent of the population files its taxes, and it is projected to rise to 15%. We want to contribute to that expansion,” he adds.

The firm is hoping that the app will be able to help it grow beyond its current locations, especially since it has plans to engage more deeply with remote areas of India, where the availability of its services in numerous Indian languages will assist it onboard new users.

Today, 60 to 65 percent of its users are from urban areas, according to Saakar, but this is expected to alter in the following years.

There are several firms in the market that provide comparable services, such as ClearTax and TaxBuddy.com — even though some businesses offered this service for free, creating an imbalance in the market. Saakar is certain that myITreturn would continue to grow because it has developed a solid rapport with its users.

The software, which claims to have created the initial electronic I-T return in India, believes that as long as it delivers the same level of service with a simple user interface and high degree of customer confidence, it will be successful.