KhaaliJeb Founder & Co-Founder’s – KhaaliJeb is a mobile money app that allows you to send and receive money, recharge, and pay vendors using the ubiquitous UPI payment network.

It is claimed that heartbreak is a powerful teacher and motivator. This isn’t just a book or film; it’s also Prakash Kumar’s story And you ll find details about KhaaliJeb Founder & Co-Founder’s Below.

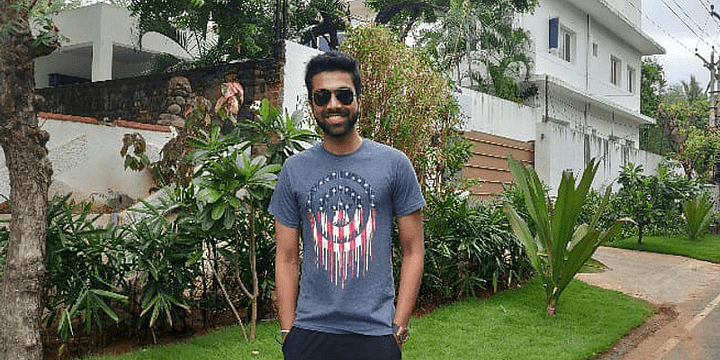

Prakash Kumar KhaaliJeb Founder

When Prakash, now 27, was in the final year of his engineering at IIIT-Allahabad in 2015, he experienced heartbreak and found himself down a path he didn’t recognize. He couldn’t concentrate on anything and had no desire to look for employment. He took a break from his studies and returned to Patna.

He wanted to go further, and the break allowed him to launch KhaaliJeb, a payment, banking, and discounts software for kids and young people.

The payment app BHIM UPI is built on top of the Unified Payments Interface (UPI). Users may send and receive money, manage recharges, and pay merchants through their bank accounts using BHIM UPI.

“The service began in Patna with OlaCabs. I took an Ola from the railway station to my house. I arrived home, and the money was taken out of my account on Ola Money. It was quite fascinating because I had no idea what was going on in the digital payment sector throughout the world while it occurred,” Prakash adds.

But the issue piqued his interest. He began looking into various payment systems from around the world and realized there was a need for something similar that addressed students.

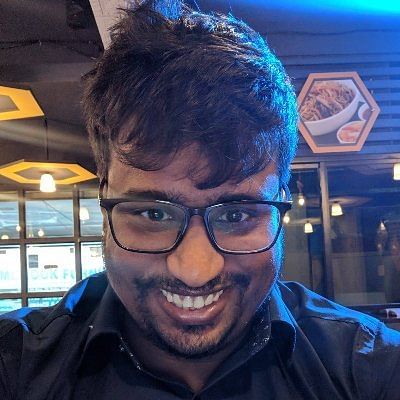

Aman Verma KhaaliJeb Co-Founder

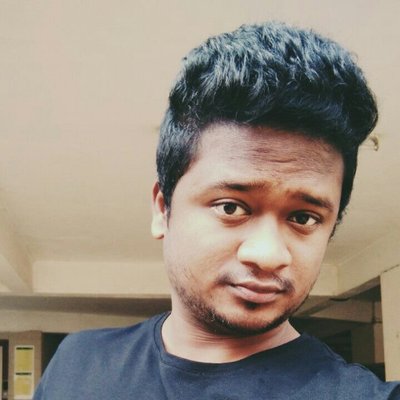

Sudhanshu Gaur KhaaliJeb Co-Founder

Wilson Birua KhaaliJeb Co-Founder

He got the idea for KhaaliJebin while at college, and he recruited his classmates and friends Aman Verma, Sudhananshu Gaur, and Wilson Birua as co-founders. They launched KhaaliJebin in January 2015 and incorporated it in March 2016 after working on it for a year.

Starting up after college

“We failed at a lot of things and made a lot of errors as novices, but we were able to make pivots and the concept continued to develop. In October 2018, we released the app on Play Store.” says Prakash.

The company was started in Allahabad, but the founders soon moved to Bengaluru, which was easier to get access to talent and promote.

Prakash says that the payment industry is extremely competitive. Many payments systems have a lot of money to invest in customer acquisition and marketing.

For a new player, the difficulties they provide are daunting. When it comes to payment apps, trust is critical for consumers. Google, Paytm, PhonePe, and others outperformed an unfamiliar name like us due to their brand image and years of creative hard effort. Even a minor presence amid such technological behemoths is difficult.

“Finding product-market fit, coming up with solid go-to-market plans, establishing trust among customers, getting new consumers, scaling up, hiring, bootstrapping, raising funds—these were some of the problems we encountered.”

The workings of the app

The KhaaliJeb app is a full-fledged UPI PSP program developed by Kotak Mahindra Bank. The target demographic for the software is students and young people aged 15 to 29 years old.

For instance, if your friend wants to gift you some money, send them a request on UPI or mobile number and they’ll get the funds in their bank account. The app does away with the need for account numbers, IFSC codes, and other information sharing. Users may also request cash directly from friends and family using the app.

KhaaliJeb’s primary emphasis is on its membership-based discount program, which provides users with special offers from various categories from businesses and corporations.

“It’s a live pan-India with a few youth-focused companies providing younger Indians under the age of 29 with unique discounts. Every other day, we add new companies. We’ve onboarded 350+ restaurants and salons in Bengaluru, each offering special offers on KhaaliJeb.” Prakash explains.

According to Aman, anyone who is 29 years old or younger must join the Discount Programme Membership by uploading their ID. “It’s a one-time process with minimal verification time.”

Focus on students

Verify by KhaaliJeb is a B2B product from payment startup KhaaliJeb, which helps brands identify student consumers and run discount campaigns for them. “It’s API/SDK-based and can be incorporated in minutes into a company’s app or website,” Aman adds.

On suggesting a friend, he says that the team is currently providing a one-month free membership to anyone who signs up.

With the next software update, children can purchase a three-month discounted membership for Rs 49. Users will get an offer code, and they’ll have to follow specific instructions to take advantage of it.

Gaana, Storytel, Cult.Fit, Testbook, and other brands provide unique services to Young Indians.

The market and model

KhaaliJeb is a platform for students to exchange ideas and learn from one another, while simultaneously learning the concepts of science, engineering, MBA courses. It has a user base of 37,000 users and more than Rs 1.4 lakh in transactions every year.

Sudhanshu claims that they make money by charging brands for Student Verification APIs, sponsored advertisements and banners for businesses, and listing fees from merchants and brands.

“Brands and merchants pay us 4-12% commission on sales they make as a result of our services. We charge brands a setup fee and a small flat fee for each ID verification using the Student Verification API. Free three-month Student Verification Services are now available to early-stage firms,” Sudhanshu adds.

According to a PwC study, India will contribute around 18.3% of the globe’s digital payments by 2023. The masses have been drawn to digital transactions because of several improvements, including Bharat QR, mobile wallets, and UPI.

Paytm, PhonePe, Google Pay, and even WhatsApp are among the giants in this category. KhaaliJeb has taken a different approach by focusing on students and running a discounting strategy it feels is the “differentiator.”

Future plans

Close to Rs 35,000 in transactions per day, and a value of Rs 3.5-4 crore in transaction value by the end of next year, according to the team’s calculations. Around 3 lakh downloads and 2.8 lakh signups are expected;

The company believes it will have up to 250,000 users by 2021. It also intends to open over 10,000 digital savings accounts, get 30+ companies on board for the Student Verification API product, and onboard 300+ brands for the discount program.

“Our first objective is to raise seed money so that we may expand the team and provide new services. We’ll have a track, manage, and split expenditures function; a digital savings account; and a micro-saving product – all geared towards children – ready to launch in the coming six to eight months.” Wilson concludes.